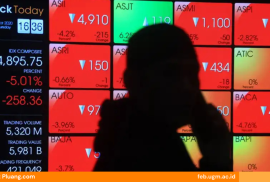

Responding to the momentum of increasing retail investors in the Indonesian capital market, on Monday (10/25/2021) the Alumni Family of the Faculty of Economics and Business Universitas Gadjah Mada (KAFEGAMA) held the second webinar of the series with the main theme “Seizing the Momentum of Rising Retail Investors in the Indonesian Capital Market: Opportunities, Challenges and Policies”.

In this second webinar, the focus of the theme being discussed is how to educate retail investors so that they can conduct wise transactions. The webinar, which was held on the Zoom platform and broadcasted via the KAFEGAMA OFFICIAL YouTube Channel, was moderated by Amirullah Setya Hardi, Cand.Oecon., Ph.D., Vice Dean of the Faculty of Economics and Business UGM and Head of Division II PP KAFEGAMA.

The webinar held by KAFEGAMA is an effort to show how KAFEGAMA can always provide benefits according to its motto, namely friendly, harmonious, and migunani. This was conveyed by Dr. Perry Warjiyo, as Governor of Bank Indonesia and General Chairperson of PP KAFEGAMA, in his remarks that started the event.

The event then continued to the keynote speech session which was delivered by Prof. Wimboh Santoso, M.Sc., Ph.D., the Chairman of the Board of Commissioners of the Indonesian Financial Services Authority (OJK). He conveyed several points, including how the pandemic has implications for people’s behavior in shopping and saving funds and how this poses challenges to educating and prioritizing investor protection.

There are three speakers from three different perspectives who gave their presentations in this webinar. The first speaker was Hasan Fawzi, as Director of Development at the Indonesia Stock Exchange (IDX). The momentum of an extraordinary increase in the number of domestic investors in the last 3-4 years requires IDX to encourage understanding through education to investors as a form of protection for investors in the midst of this euphoria.

So far, IDX together with OJK and capital market industry players have carried out various educational activities which are divided into increasing literacy, increasing inclusion, and increasing investor activation. Not only that, IDX also created a special educational program for social media influencers with the aim of helping spread the importance of investing well to the public.

The second speaker was Nofry Rony Poetra, as Director of Finance, Planning, and Treasury at PT Bank Tabungan Negara Tbk (BTN), who gave a perspective as an issuer in the capital market. Nofry explained several important things that must be considered related to investment, including learning the types of investment instruments, understanding the instruments to be purchased, setting investment goals, and managing finances in a healthy way.

BTN as a bank also plays a role in supporting the investment climate, one of which is by carrying out the “Life is not Just About Today” campaign which targets potential investors from among young people. It is hoped that this campaign will help potential young investors prepare for a healthier financial condition for their future.

Furthermore, the event continued with a presentation by the third speaker, Prof. Dr. Mamduh M. Hanafi, MBA., Lecturer in the Department of Management, Faculty of Economics and Business UGM. Prof. Mamduh discussed the topic of the webinar from an academic point of view on how to educate potential investors so that the phenomenon of fear of missing out (FOMO) is no longer common.

According to him, retail investors tend to behave differently which leads to poorer individual performance. Therefore, Prof. Mamduh developed a strategy to build competitive retail investors. This strategy is carried out by improving the behavior of retail investors through education that can reduce behavioral bias, providing assistance and training to potential investors, and institutionalized trading by encouraging retail investors to enter institutions and then monitor them. “We want the Indonesian capital market, including retail investors, to grow healthily and sustainably,” he said at the same time closing the webinar.

Reportage: Kirana Lalita Pristy/Sony Budiarso.