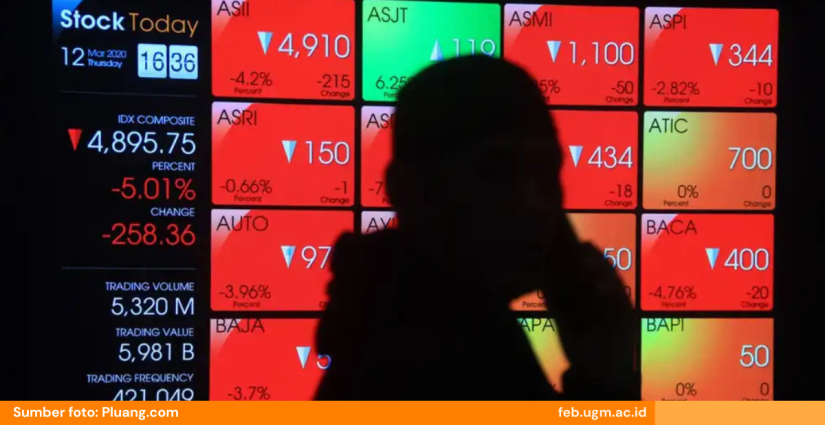

Sharp volatility has shaken the Indonesia Stock Exchange (IDX). The Composite Stock Price Index (IHSG), which had previously reached an all-time high of 9,134.70, plunged dramatically on January 29, triggering a trading halt for the second time.

Professor of Finance at the Faculty of Economics and Business, Universitas Gadjah Mada (FEB UGM), Prof. Dr.rer.soc. R. Agus Sartono, M.B.A.,, stated that the significant decline in the IHSG, commonly referred to as the January Effect, was driven by a crisis of confidence in the transparency of Indonesia’s capital market, which in turn triggered a chain reaction among global investors. This condition arose from a decision made by Morgan Stanley Capital International (MSCI), a global investment research firm that provides stock indices and portfolio analysis to institutional investors worldwide.

“MSCI implemented an interim freeze, effectively suspending the assessment of Indonesian stocks, which subsequently shattered short-term growth expectations,” he explained in a written statement received on Saturday (January 31, 2026).

Agus Sartono explained that MSCI took this step due to concerns about the lack of transparency in data on beneficial ownership structures and the high concentration of ownership in several large-cap stocks. Broker codes and domicile codes were closed during trading hours. Furthermore, stocks under special monitoring may be subject to a full call auction, resulting in non-transparent price formation, as buy and sell order queues are not visible.

This uncertainty, he continued, prompted massive net selling by foreign investors, reaching IDR 6.17 trillion on January 28. The following day, January 29, 2026, foreign net selling continued at approximately IDR 4.63 trillion.

“These factors put pressure on the IHSG, turning the Indonesia Stock Exchange into a thin market and making it easier for stocks to become subject to manipulation,” said the lecturer from the Department of Management, FEB UGM.

Agus Sartono added that the resignation of the President Director of the IDX on January 30, 2026, was perceived as a form of accountability for the extreme market turbulence, but ironically further destabilized the market. It was followed by the resignation of the Chairman of the Board of Commissioners of the Financial Services Authority (OJK), Mahendra Siregar, and the Chief Executive of Capital Market, Derivatives, and Carbon Exchange Supervision at OJK, Inarno Djajadi, also on January 30, 2026. These developments further intensified market pressure.

Why Did the Market React So Quickly?

Agus Sartono explained that the bottom line of investment, whether in tangible assets or financial assets, is fundamentally based on expectations of an asset’s ability to generate future free cash flows. In addition, investments must yield returns on invested capital that exceed the cost of capital.

MSCI’s decision raised concerns among investors that stock prices no longer reflected their actual value. There were fears that transactions were merely artificial, conducted by investors acting as extensions of the majority shareholders, while the company’s fundamentals remained weak. This concern is difficult to dismiss given the relatively small volume of retail transactions, suggesting that many investors are following market trends without sufficient understanding.

“Research conducted by my supervised students at FEB UGM also shows the presence of FOMO (Fear of Missing Out) behavior, where investors buy and sell stocks merely by following others, without adequate knowledge of how to assess investment securities properly,” he explained.

Agus also mentioned that market expectations of future liquidity losses influenced the sell-off that drove the IHSG’s plunge. This condition encouraged herding behavior, where domestic investors also rushed to sell their assets to avoid larger losses. Instead of easing pressure, these actions deepened the index’s decline.

According to him, the recent drop in the IHSG was not merely a technical fluctuation but rather a reflection of global demand for higher governance standards. In this context, OJK and IDX face an urgent and substantial task to strengthen free float regulations and beneficial ownership disclosure to restore investor confidence.

Lessons for Investors

Agus Sartono emphasized that the capital market serves as a medium for long-term investment financing. Through Initial Public Offerings (IPOs), companies can raise capital to support growth. In developed countries, stock market indices often serve as indicators of economic progress. Strong corporate performance contributes to higher tax revenues, job creation, increased per capita income, stronger purchasing power, and poverty reduction.

However, he stressed that the government, through OJK, needs to re-evaluate regulations that allow companies with negative free cash flow to conduct IPOs. In addition to protecting small investors, this step is crucial to preventing inappropriate corporate actions. Several startup IPOs with negative cash flows that initially drew strong demand due to overly optimistic prospectus information have taught a bitter lesson: their stock prices later collapsed in the secondary market, causing significant losses for investors.

The Importance of Public Information Transparency

Agus Sartono underscored that the root of the problem lies in the lack of transparency in public information, which undermines market trust. The more advanced a stock exchange, the stricter its listing requirements are to protect all stakeholders. Public companies are required to present comprehensive, transparent, and standardized financial information, supported by credible accounting professionals and rating agencies.

Therefore, public education on company valuation must be intensified to protect investors’ interests and ensure that investment decisions are not driven solely by euphoria.

In the current situation characterized by relatively high unemployment, slowing credit growth, and rising deficit risks, Agus Sartono believes investors need to refocus on company fundamentals and closely monitor economic indicators. He argued that a transition back to a Free Cash Flow (FCF) based approach is a strategic necessity to restore market credibility.

“FCF prevents potential manipulation of financial performance,” he stated.

He added that FCF is more rational and better reflects a company’s ability to sustain its operations. Unlike net income, which can easily be distorted by accounting policies, free cash flow accurately reflects the cash available to shareholders after operating expenses and capital expenditures have been incurred. It provides a clearer picture of future growth potential.

“Investors should be more cautious when they see negative FCF alongside positive accounting profits. This can serve as an early warning signal of irregularities or an unsustainable business model,” said Agus Sartono, who previously served as Deputy for Education and Religious Affairs at the Coordinating Ministry for People’s Welfare / Human Development and Culture (2010–2021).

FCF-based valuation methods, such as Discounted Cash Flow (DCF), he continued, force market participants, both investors and analysts, to focus on a company’s ability to generate cash independently. Equally important, the FCF approach compels management to be transparent in their use of money.

The market crisis reflected in the IHSG’s plunge at the end of January 2026 serves as a reminder of the importance of an information-efficient capital market. The IDX and OJK are required to ensure that all listed companies fully comply with regulations and disclose information comprehensively, even if this increases corporate costs. However, Agus stressed that transparency and integrity are the foundation of trust.

“Building trust requires hard work and a long process. We may suffer losses from the stock market crisis at the end of January 2026, but we must not lose our confidence, integrity, and reputation,” he concluded.

Reported by: Kurnia Ekaptiningrum

Sustainable Development Goals