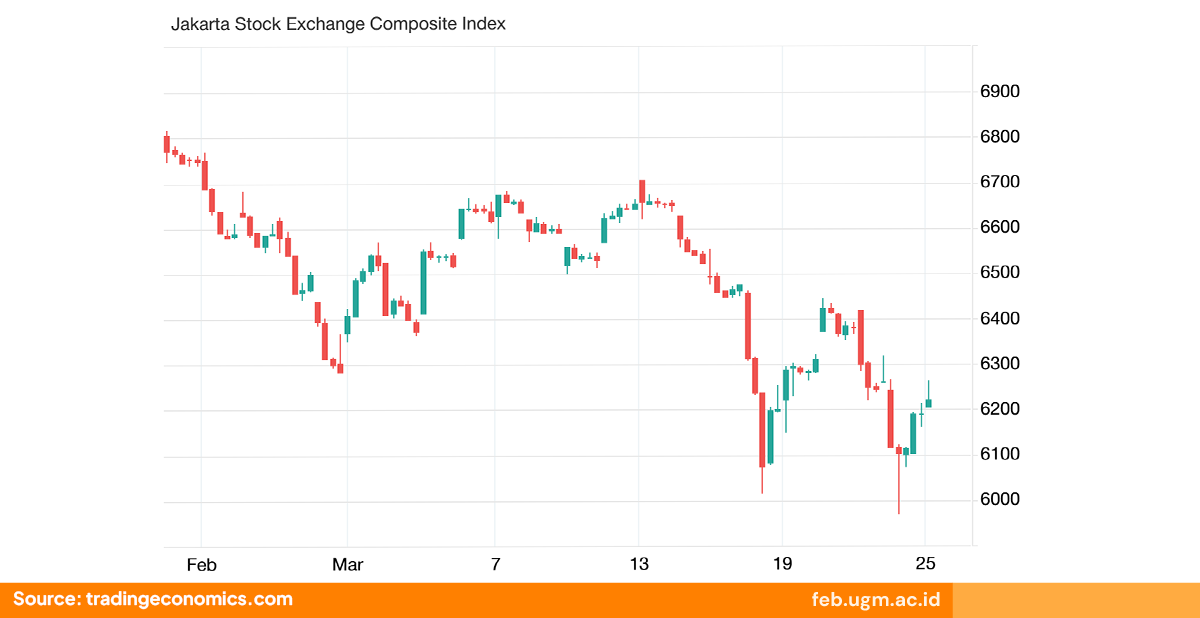

The sharp decline of the Jakarta Stock Exchange Composite (JKSE) has put significant pressure on Indonesia’s capital market, triggering a trading halt or temporary suspension of stock trading. Dr. I Wayan Nuka Lantara, a lecturer at the Department of Management, Faculty of Economics and Business, Universitas Gadjah Mada (FEB UGM), said this phenomenon reflected a crisis of confidence among domestic and foreign investors regarding Indonesia’s political and economic situation.

“The plummeting JKSE indicates a negative outlook among market participants. When the index falls sharply, the share prices of companies with the largest market capitalization, especially in the banking sector, experience significant declines. This decline leads to a loss of confidence among investors, causing them to sell their shares quickly,” he explained.

As a banking, finance, and investment analyst, Wayan pointed out this pessimism is due to several factors. First and foremost is political and economic uncertainty, which creates the perception that the government is not taking the potential crisis in Indonesia seriously.

Wayan noted that this is evident in several policies that fail to reassure the market. For instance, while the government urges the public to practice efficiency, it fails to apply the same principles, as seen in the oversized cabinet.

In addition, worsening economic conditions, including declining consumer purchasing power and unrealistic economic growth targets, have further exacerbated the situation. The widening budget deficit and the growing burden of public debt, due to be repaid in June 2025, add to the concerns.

From a political perspective, stability and law enforcement have become significant concerns with enacting several controversial laws that have sparked public discontent. The lack of clear political direction and tangible initiatives has eroded public confidence.

Impact on the National Economy

Wayan emphasized that this uncertainty has far-reaching consequences for Indonesia’s economy. One of the most affected groups is young and inexperienced domestic investors just starting their investment journey.

“This situation may discourage them from investing. Even those who have saved for years to invest are now seeing their asset values plummet,” Wayan added.

On a larger scale, these conditions could slow economic growth, reduce new investment, and increase unemployment due to widespread layoffs. If the situation does not improve, the country could face the risk of economic collapse.

“The growing debt burden, coupled with declining tax revenues, could lead to rising public discontent and potential social unrest, which could even escalate into riots,” he warned.

Lessons from the COVID-19 Pandemic

Wayan stressed that the government must seriously commit to managing the situation to address this crisis. He also criticized the government’s poor communication strategy, which often comes across as dismissive, further fueling uncertainty.

He pointed out that lessons from the COVID-19 pandemic offer valuable insights for managing market panic. During this period, the government implemented an asymmetric auto-rejection policy that limited stock price declines to a maximum of 7% daily. In addition, more transparent policy communication on economic recovery efforts could help restore market confidence.

Wayan suggested three key measures for the long-term recovery of the JKSE: First, the government should establish clear and realistic economic recovery policies. Second, it must enforce laws more firmly and fairly without selective enforcement. Third, it should ensure better political stability by avoiding controversial policies.

Wayan advised investors to be more cautious in their investment decisions. They should hold onto cash assets, seek additional sources of income, and reassess their spending habits.

“If possible, hold on to cash and strengthen emergency funds. Continue to invest in more stable instruments such as government bonds, deposits, or gold,” Wayan suggested.

Despite the current market challenges, Wayan remains optimistic that Indonesia can regain investor confidence with the proper measures.

“Even the slimmest hope must be maintained. But hope alone is not enough; concrete actions by all parties, especially the government, are crucial,” he concluded.

Report by: Shofi Hawa Anjani

Editor: Kurnia Ekaptiningrum

Sustainable Development Goals: